Upstate NY Commercial Tax Credit is #1 in NY State

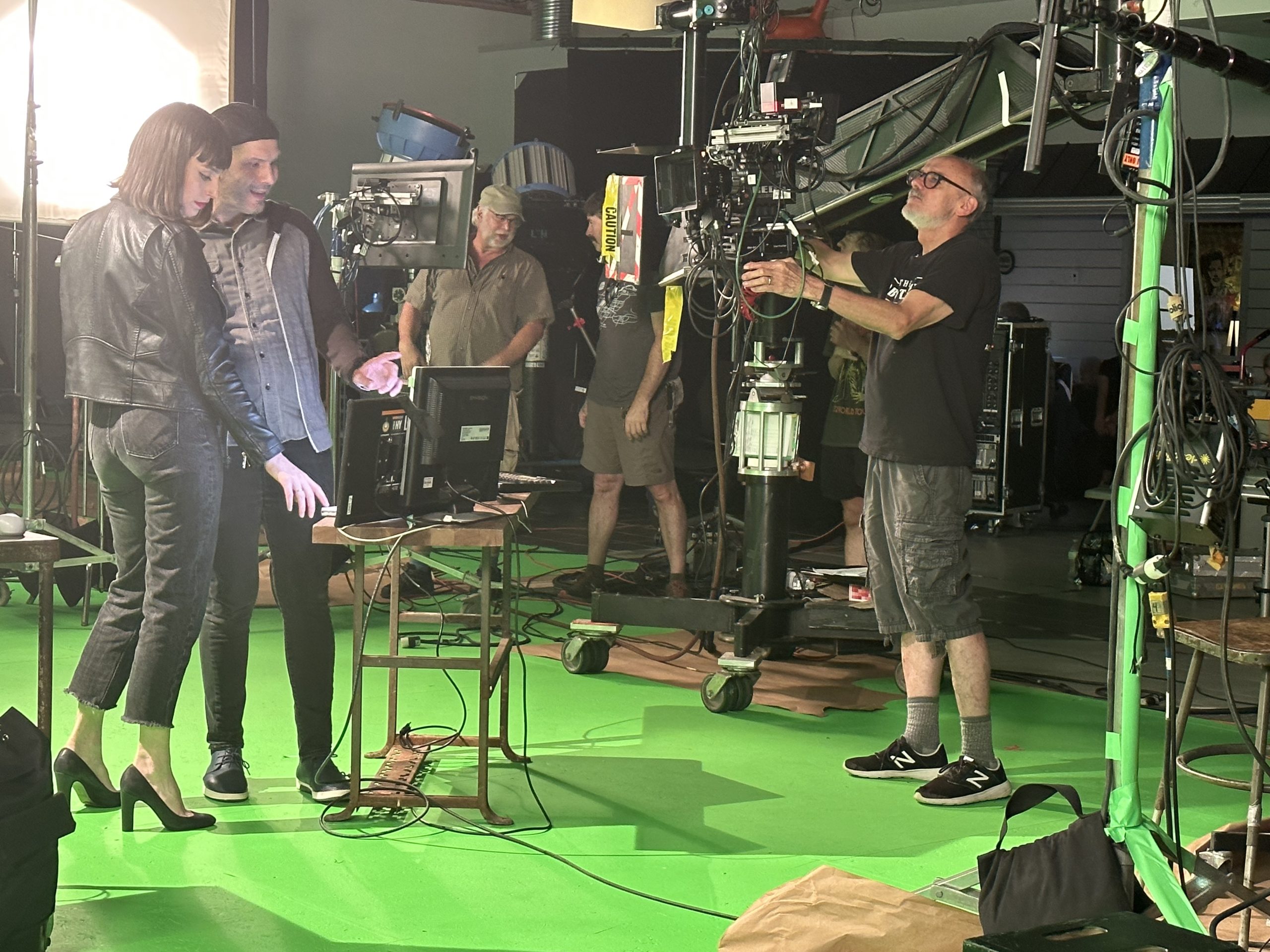

Want to learn about Virtual Production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

The Cobalt Experience and Why it Matters

As a “By Producers, For Producers” Turnkey Soundstage, we understand the pressure productions feel even during the best of times. We manage teams, budgets, and all sorts of complexity. We also nurture creativity and collaboration— all at the same time. It’s a tall order! But during these times… everything is magnified… So, if your workspace is uncomfortable or inconvenient, you’re really gonna feel it.

Nothing kills good energy and creativity more than stress and struggle; therefore, our “Production Reimagined.” mindset is all about practicality and thoughtfulness. We care deeply about helping our clients raise the vibration onset, so everyone can feel their best, AND to focus on the work. With non-traditional soundstage amenities like relaxation areas, aromatherapy, cozy furnishings, and our VIP Spa Trolley, we welcome you to make yourself a home away from home with us.

Clients tell us their days on set are invigorated by access to breakout spaces with flexible work stations, and private conference rooms, and Nature right outside. Private spaces are essential to us, as are the areas that also support collaborative work. Throughout our facility you’ll find a balance of both — designed to boost performance, productivity, and yes—Happiness 🙂

Providing a production environment that's furnished, with access to an exceptional inventory of tools and technology is our pleasure. We offer advanced Livestreaming and Video Village with networked monitors and stage views strategically positioned throughout our space. This way, teams can spread out, share ideas, keep track of shooting, and collaborate in real-time. And our sweet Town of Woodstock offers a chill vibe to help everyone relax just a titch more than they might in good ole, industrial Brooklyn.

If you haven’t already, please come by to check us out—either on zoom or in-person. We love turning people on to Woodstock’s unique charm, and sharing all that EXTRA hospitality we put into the Cobalt experience.

The New York Commercial Tax Credit Program

The New York Commercial Tax Credit Program

New York State (NYS) has always been a hub for the Industry, with a bustling production scene and diversity of talent. To further stimulate growth and attract more commercial production, NYS offers the Commercial Tax Credit Program, tailored specifically for the Industry.

This initiative aims to provide financial incentives to production companies, making it more appealing to shoot commercials and other media projects in the state.

Here, we take a look at the specifics of the program, its benefits for the Industry, how production companies can leverage these credits, and where the best place is to shoot (HINT: IT’S UPSTATE).

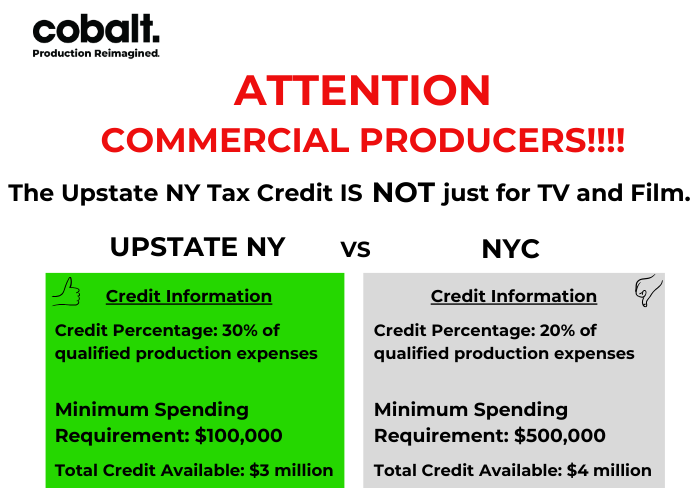

The Difference Between Shooting in New York City vs. Shooting Upstate

If you’re thinking about shooting in New York State, there’s a big difference in savings between filming in Upstate vs. Downstate. The two regions are defined as follows:

Downstate

The Downstate component is based on filming or recording qualified commercials within the Metropolitan Commuter Transportation District (MCTD), which includes New York City, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester counties.

Upstate

The Upstate component is based on filming or recording qualified commercials outside the MCTD but within NYS.

Key Differences Between Filming in Upstate vs. Downstate

Spend

Upstate, you only need to spend $100,000 to start receiving benefits, whereas in downstate, you need to spend $500,000.

Credit

The credit offered for Downstate is $4 million and $3 million for Upstate, for a total of $ 7 million per year offered.

Rebate Percentage

The rebate percentage is 50% greater upstate compared to downstate.

Winner: UPSTATE NEW YORK

Understanding the NYS Commercial Tax Credit Program for the Entertainment Industry

The NYS Commercial Tax Credit Program is designed to encourage commercial production within the state by offering tax credits for eligible expenses.

The program targets various aspects of commercial production, including:

- Pre-production

- Production

- Post-production

By providing these incentives, the state aims to boost economic activity, create jobs, and solidify New York’s reputation as a premier destination for media production.

Key Features of the Program

- Eligibility Criteria: The program is open to production companies that create commercials, music videos, and other media content. To qualify, companies must incur specific production-related expenses within New York State.

- Types of Tax Credits: The program offers tax credits for various production-related costs, including:

- Production Costs: Expenses related to filming, such as camera equipment, lighting, and sound.

- Labor Costs: Wages and salaries paid to crew members, actors, and other production staff.

- Post-Production Costs: Costs associated with editing, special effects, and sound design.

- Application Process: Production companies must apply through the New York State Governor’s Office for Motion Picture and Television Development. The application process requires detailed documentation of expenses and how they contribute to the production within New York.

Benefits of the NYS Commercial Tax Credit Program for the Entertainment Industry

The NYS Commercial Tax Credit Program offers numerous benefits tailored to the needs of the entertainment industry, including:

- Financial Incentives: The tax credits help reduce the overall production costs, making it more feasible for companies to shoot commercials and other media projects in New York.

- Job Creation: The program promotes job creation by encouraging production companies to hire local talent and crew, contributing to the state’s employment growth in the entertainment sector.

- Economic Development: By attracting more commercial productions, the program stimulates local economies, driving demand for various goods and services such as hotels, catering, and transportation.

- Competitive Edge: Offering attractive tax credits makes New York a competitive location for commercial production, drawing in projects that might otherwise go to other states or countries.

How to Apply

Applying for the NYS Commercial Tax Credit Program involves several key steps:

- Research Eligibility: Production companies should first determine if their project meets the eligibility criteria for the program. This includes understanding the specific tax credits available and how they apply to their production activities.

- Prepare Documentation: Gather all necessary documentation, including detailed expense reports and descriptions of how these expenses relate to the production within New York State.

- Submit Application: Complete the application form available on the New York State Governor’s Office for Motion Picture and Television Development website and submit it along with the required documentation.

- Follow Up: After submitting the application, production companies should follow up with the office to ensure their application is being processed and to provide any additional information if needed.

Final Thoughts

The NYS Commercial Tax Credit Program is a valuable resource for the entertainment industry. It provides crucial financial incentives that make commercial production more affordable and attractive in New York State.

By offering these benefits, the program helps create jobs, stimulates economic growth, and reinforces New York’s position as a leading center for media production.

Production companies interested in taking advantage of this program should carefully review the eligibility criteria, prepare thorough documentation, and submit a complete application to maximize their benefits.

Resources

- New York State Governor’s Office for Motion Picture and Television Development

- NYS Department of Taxation and Finance

- Production Tax Credit Information

- Post-Production Tax Credit Details

By tapping into the resources provided by the NYS Commercial Tax Credit Program, production companies can enhance their projects while contributing to the vibrant entertainment landscape of New York State.

Want to chat about filming in New York? We’d love to chat about getting you started.

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

How Modern Filmmakers Use Virtual Production: A Few Examples

How Modern Filmmakers Use Virtual Production: A Few Examples

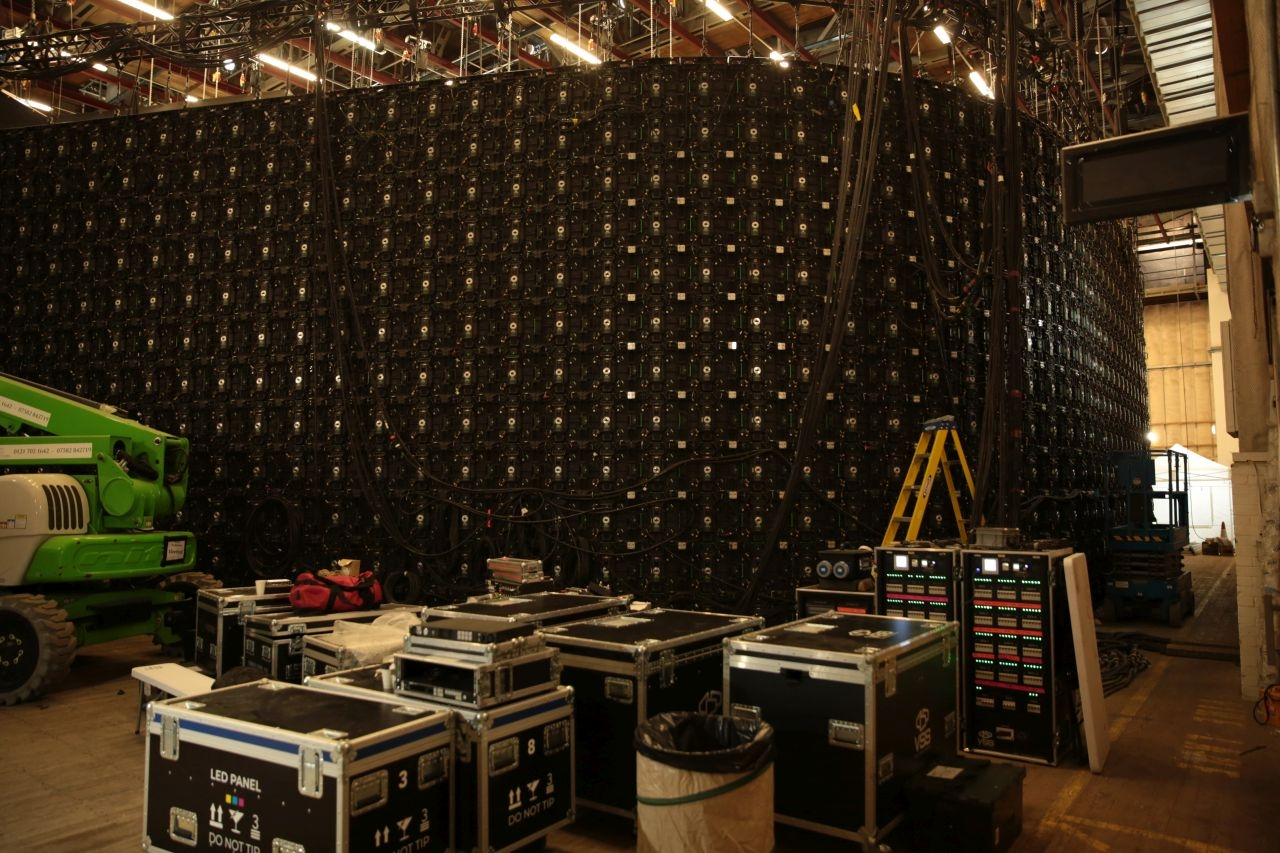

Virtual Production has undoubtedly revolutionized the way movies and TV shows are made. It offers modern filmmakers a new vehicle for storytelling, with unprecedented flexibility and immersive realism.

From developing post-apocalyptic landscapes to aging characters over decades, Virtual Production technology has been a game-changer for the Industry.

Here, we take a quick minute to explore some of the standout films and performances that have taken advantage of VP, showcasing the innovation and creativity that drives today’s filmmaking.

Midnight Sky

“The Midnight Sky” stars George Clooney (who also directed the Netflix film) as Augustine, a brilliant but reclusive scientist researching other habitable planets. This becomes crucial when humanity is nearly wiped out and Earth is contaminated by deadly radiation.

“The Midnight Sky” used ILM’s StageCraft technology for its virtual sets in two main scenes:

- Early in the movie, LED screens created the effect of Augustine observing the vast arctic wilderness from an observatory.

- Later, the screens facilitated communication with a spaceship.

Virtual Production was used from the very beginning to previzualize important scenes, including a spacewalk and a sequence in which a habitation pod sinks into freezing water.

What’s even cooler is that 3D models of the respective environments were built and populated with virtual humans (synthespians). Everything created was easily viewed on an iPad.

This virtual technology enhanced the realism and immersion for both the actors and the audience. It was planned to be used in the wide IMAX release, which was curtailed by COVID.

The Witcher

Netflix’s “The Witcher” uses a combination of green screen and Virtual Production to recreate entire fantasy worlds on a TV budget.

The series uses extensive virtual sets with CGI elements to recreate elaborate, immersive environments that seamlessly blend with practical sets. Traditional green screen techniques are combined with CG assets rendered in post-production, giving it a particularly gritty aesthetic.

This strategy enhanced the show’s visual fidelity while streamlining the production process, allowing for greater creative freedom and flexibility.

For Season Two of the hit series, the EFX team brought its new AR visualization tool Cyclops to set. This tool provided production team members and crew the ability to view digital characters and assets in a real-world context as they planned the storytelling action.

Giddy-up P.A.’s!!!

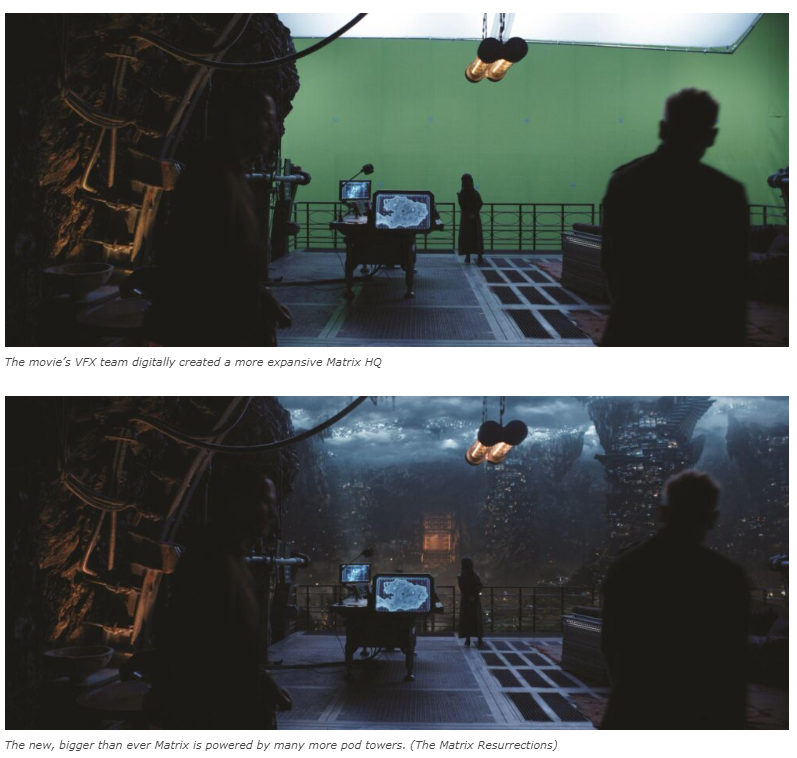

The Matrix Resurrections

Nearly two decades after The Matrix Reloaded and The Matrix Revolutions seemingly concluded the saga of our hacker friend Neo and his fellow freedom fighters, the final installation was released in 2021.

Lana Wachowski directed and co-wrote the film, which brought back VFX supervisor Dan Glass. Using Virtual Production, he achieved the visual effects for Yahya Abdul-Mateen II’s sentient, fluid-like Morpheus.

How did they do this? The character Yahya (and actor) is in scenes delivering dialogue with the other actors, and then he’s painted out. The EFX team used a head cam to capture his facial animation so they could mimic what he does and then use that data to drive a fluid simulation for the character.

Another scene that uses various aspects of Virtual Production is the chase scene at the end through San Francisco. It was an excellent collaboration of all different trades. It starts with a lot of practical set elements. Real actors on a gimbaled bike are being pulled around, with stunt extras running after them. However, shots with people dive bombing were all CG.

Oblivion

One of the first significant applications of Virtual Production in a major Hollywood film was for the 2013 sci-fi adventure, “Oblivion.”

The film is set in a post-apocalyptic 2077 where Earth is uninhabitable, and the Moon has been destroyed due to an alien invasion. Tom Cruise stars in dual roles as two clones of a man named Jack Harper.

For “Oblivion,” the primary use of virtual sets was to create the Sky Tower location.

While the floors, walls, and ceilings of the towers were physical sets, the surrounding sky and clouds were projected onto a wraparound backdrop.

While earlier movies and TV shows had used basic forms of Virtual Production, “Oblivion” is considered a pioneering example of modern Virtual Production techniques.

Ghost in the Shell

The 2017 live-action remake of “Ghost in the Shell” received praise for its stunning visual effects. Set in a near-future Japan where the line between humans and robots is blurred, the film relied heavily on digital and computer effects to recreate its cyberpunk cityscape.

One standout feature was the creation of nearly 400 “Solograms” (holographic advertisements), which were integrated into the virtual city setting. The scale of these 3D images was unprecedented.

Other Uses of Virtual Production

Katy Perry’s live performance of “Daisies” on American Idol marked a historic moment in television with the extensive use of Extended Reality (XR).

The 3D virtual environment included interactive elements like a house, chair, and flowers, allowing Perry to interact with these virtual objects in real time.

Summing it Up

The integration of Virtual Production into filmmaking has marked a significant leap forward for the Industry, allowing for more dynamic, immersive, and visually stunning productions. From early adopters like “Oblivion” to recent hits like “The Midnight Sky,” VP has proven its worth in creating believable worlds and enhancing storytelling.

As Virtual Production continues to evolve, we can expect even more groundbreaking applications that will push the boundaries of what is possible on screen, transforming our viewing experiences and setting new standards in visual storytelling.

Ready to get started with Virtual Production?

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

Summer is Swinging in Woodstock… and at Cobalt!

Summer is Swinging in Woodstock… and at Cobalt!

Summer is finally here and the Cobalt Team couldn’t be more excited to show new clients and old friends everything in Woodstock.

We’re so busy with work that it can be hard to get to all of the happy events in the area, but that won’t stop us from telling you, dear friends and clients, about it ALL! That way you, your team, business partners, and talent can get out and explore everything Woodstock has to offer outside the stage!

Here’s just a small sample of some of the fun this summer ☀️

June Events

Saturday, June 22

Western and Swing BBQ & Dance at the Ashokan Center

Dine, dance, or just enjoy a great evening of Swing & Classic Country music under Ashokan’s outdoor pavilion! Learn swing and two-step basics and then get down to live music by “Jay Ungar & Molly Mason and the Western & Swing Week” house band.

Wednesday, June 26

Sunset Flix: Goonies at Hasbrouck House

Post up on the Great Lawn for FREE weekly films, food and fun all summer long!

Bring a picnic blanket, camping chair and your furry friend! Tables are first come, first serve.

Saturday, June 29

Music in the Meadow at Shandaken Inn

Saturday from 1 P.M. – 4 P.M. with Krisha Patenaude, Gabe Marquez, Jared Nelson, Alex Endrez, Dan Steen, and John Morrison from The 209s, while they play funky covers and originals from the heart of the Hudson Valley.

Follow The Arrow Festival at Arrowood Farms Brewery and Distillery

“Follow The Arrow Festival” is set for Saturday, June 29th at Arrowood Farms in Accord, NY. Marco Benevento, the Joe Russo’s Almost Dead keyboardist, will fill out a sizable chunk of the lineup.

Benevento will perform three sets throughout the day: a headlining performance with Phish bassist Mike Gordon, a solo set with his eponymous trio, and a Benevento Family Band set.

Sunday, June 30

Cumbia Night with Son Rompe Pera at Opus 40

Born and raised in Naucalpan, the deep outskirts of Mexico City, the Gama brothers and their band Son Rompe Pera have thrashed through all preconceived notions of what a marimba-centered band is. They’ve rendered the instrument inseparable from their punk ethos.

Their shows have become home to the now-infamous marimba mosh pit across the globe. Their music joins intergenerational audiences in moments of essential release and community around their hard-hitting, forward-thinking, unrelenting punk-infused cumbias.

July Events

Wednesday, July 3

Deer Tick at Levon Helm Studios

Come out for a night of alt-country at the legendary Levon Helm studios with Deer Tick.

Saturday, July 13

MAD presents the 10th Annual Celebration of the Arts EXPO at the Kingston Center of SUNY.

Kingston Midtown Arts District (MAD) presents its 10th Annual Celebration of the Arts EXPO! It will take place Saturday, July 13 10am – 4pm at the Kingston Center of SUNY Ulster at 94 Mary’s Avenue in Midtown Kingston, NY.

Celebration of the Arts EXPO (COA EXPO) is a FREE, community-wide event designed to introduce Kingston residents to local, working artists, and engage them with hands-on opportunities to explore various art forms.

Saturday, July 20

Simon’s Dream, The Music of Penguin Café Orchestra at Maverick Concerts

Simon’s Dream represents a rare chance to hear the eclectic and uplifting music of the seminal British instrumental group Penguin Cafe Orchestra. The live music includes members of the original ensemble.

Belleayre Beach Movie Night: Barbie at Belleayre Mountain

Step into a world of enchantment under the stars at Belleayre Beach! Make it even more memorable and come dressed as your favorite Barbie character. Grab your favorite snacks and refreshments at the Snack Shack, and get comfortable with a cozy blanket or rent a chair.

Saturday, July 27

Euphonia! Mini-Brass Fest at Opus 40

In partnership with Opus 40 and brought to you by the folks behind the Brassroots Festival, Euphonia! is an all ages event that aims to delight the senses through craft-making, multi-sensory experiential art, highly danceable brass music, and more!

August Events

Saturday, August 10

35th Annual Blueberry Festival in Ellenville

35th Annual Blueberry Festival with vendors, food court, and music in the Village of Ellenville!

August 20 – 25

The 6-day Dutchess County Fair will feature Agriculture, Horticulture, Turn-of-the-Century Treasures, Working Blacksmith Shop & Gas Powered Engine Show, and so much more.

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

DogTV Takes Over Cobalt

Case Study: DogTV Takes Over Cobalt!

Challenge

Filming with animals is always a challenge! Our client DOGTV—a channel for dogs to watch when they’re home alone—required a quiet set and a calm environment to keep the dogs from getting overstimulated and barking. Additionally, this project required lots of space to spread out. That meant hair, makeup, and a talent holding areas for 30 pups with a pair of handlers for each, plus workspace for the team to produce more than 60 different video assets, ANND still photography! Regarding DOGTV’s rebrand shoot, Ron Levi told us, “It’s been a decade since we did the branding, so this project was so important for us. It wasn’t just another shoot. We were really excited about this, but we weren’t sure how it was going to work out.”

Solution

Ron commented, “When I toured the studio, I immediately understood this is the place for us.” Cobalt’s spacious soundstage allowed DOGTV to maximize their time on set, bringing two dogs on set at a time: one team captured stills while the other worked on the video. To achieve this level of multitasking, the photography studio was set up in Cobalt’s garage while the video team used the soundstage. Two separate sets allowed complete separation between the dogs. Once each side wrapped, the crew would swap the dogs to the opposite set. While this was great for production, it also allowed the canine stars to stay relaxed. “We took over the whole building,” said Ron. “We opened a whole salon with human groomers and dog groomers!”

Impact

Cobalt’s spacious facility allowed DOGTV to film 30 dogs over two days, with plenty of space for a robust production team, and all the dogs’ “parents.” Cobalt rose to the challenge of hosting these lovable (yet unpredictable) pets with a uniquely versatile space, and amenities that bred efficient production flows, and a calm environment. “Everything was perfect,” said our enthused client. “I can’t wait to do it again and create another big shoot!”

Cobalt would love to welcome back the cast and crew of DOGTV any time!

If your production has unique needs, we can accommodate them.

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

Hosting Charlamagne tha God and a Cast of 30

Hosting Charlamagne tha God and a Cast of 30!

Challenge

A major multinational content producer brought a shoot to Cobalt, and Charlamagne tha God was part of it! First, the client needed a quick save (booking in the weekend before yikes!), so we fast tracked the usual Grip and Electric schedule. Extra spaces were required to creatively accommodate their Star Talent, his guests, and 30 cast members. With the production team and crew members, there were about 60 people in the studio! Finally, the project required a “black box” filming environment, and they needed a totally separate space for a still shoot.

Solution

Of course, Cobalt came through! The client officially booked on Saturday, and gave us the G&E list on Sunday. We orchestrated our vendor partners and in-house production tools, and they were good to go Monday morning! Their catering team set up shop in our spacious Home Ec area, and served cast and crew in our Craft Service Kitchen. We provided black Duvetyne fabric for the project’s scenery, and our 2,000 sq ft upstairs insert stage was geniusly allocated for the stills portion of the grand gig.

Impact

The shoot was a great success, with no issues! This is where our Swiss Army Knife experience really shines. Whether it’s having close vendor relationships to tap in for last-minute needs, loads of versatile, separate nooks and crannies to host people, or access to a whole additional kitchen for catering, we are truly ready for anything! The star was delighted with our VIP amenities, and the production went super smooth—who could ask for more?

Want to learn about Virtual Production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

Our NEW 12K camera!! Her name's URSA: The Ursa Mini Pro 12K

Our NEW 12K camera!! Her name's URSA: The Ursa Mini Pro 12K

At Cobalt, you can unlock loads of creative potential with access to our premier soundstage and top-of-the-line equipment.

We offer an array of elite production tools to elevate your projects to new heights! Say hello to our little friend!

Blackmagic Design - Ursa Mini Pro 12K

Meet the outstanding and versatile 12K Ursa. She offers 36 times HD, and is a powerhouse of innovation that redefines what’s possible. With her ability to shoot high, wide, and beyond, this camera empowers you to explore creative compositions in post-production, thanks to its massive digital negative.

And the best part?

She has everything a seasoned cinematographer would want, all in a compact workhorse of a machine! She’s got a PL lens mount; an optical, low-pass filter; high dynamic range; an internal ND filter; and an easy to navigate user interface.

She boasts 4K live output and up to 12K recording capabilities (with the option to record at 8K without cropping the sensor). The Ursa 12K ensures exceptional performance and excellent dynamic range without overwhelming you with unnecessary data. When it comes to resolution, there’s no such thing as too many K’s!

Leica Summicron Lenses

Summicron stands for powerful performance.

Leica Summicron lenses have long been the standard by which other lenses are judged. Our lenses are the same EXACT SET used to shoot the feature film “The Revenant,” which won an Academy Award for Best Cinematography.

Who Are We?

Cobalt combines state-of-the-art stages and savvy production solutions—a true all-in-one answer. Decades of firsthand experience showed us the value of a fully equipped, turnkey production campus, so we created Cobalt to encompass our values of hospitality, superior support, innovative technology, and unprecedented accessibility.

Cobalt was the first to offer Virtual Production to the East Coast film community in 2015. We are woman-owned and led.

Take advantage of our amazing inventory of production tools and elevate your image for your next project with us!

Want to learn about Virtual Production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

Upgrade Your Visual Story with Our High-Performance Production Tools

Upgrade Your Visual Story with Our High-Performance Production Tools

Welcome to Cobalt Stages, where we redefine image quality and elevate your creative vision to new heights. Are you ready to take your productions from standard to stunning?

Look no further. We’re as passionate about image crafting as you are.

To inspire creativity at the highest level, we make some of our most cutting-edge equipment available to you when you rent our world-class soundstages.

Introducing our arsenal of high-end production tools designed to transform your projects!!!

Mo-Sys Production Suite

Mo-Sys? Like that guy with the beard?

We hear it all the time. Moses this, Moses that. Why are we always talking about Moses?

The Mo-Sys VP Pro VFX is a complete solution for our Virtual Production needs. It comes with a full suite of creative tools that will embed directly in the Unreal Engine for augmented graphics, virtual sets, and overall mixed reality.

In our Mo-Sys Production Suite, we offer:

High-Quality Camera Tracking

The StarTracker optical tracking system is called that because it looks at ‘Stars’ on the ceiling. These are small, retro-reflective stickers, randomly applied to the studio ceiling or onto the floor.

The StarTracker’s LED sensor (mounted on the studio camera) then shines infrared light at the stars. In turn, the system remembers the ‘StarMap’. StarTracker reports the position and orientation of the studio camera in real time to the rendering engine.

Absolute Tracking

The StarTracker system does not drift, unlike mechanical encoded pedestals that work on dead-reckoning and accumulate error with distance traveled. Since StarTracker is always referencing itself to its star map, its position is absolute and drift-free.

Freedom of Movement

StarTracker has unlimited freedom of movement and gives accurate position, rotation and lens data in real-time.

This makes the StarTracker system ideal for Steadicam and handheld. You can rotate the studio camera 360 degrees, and move it to any position in the studio, even right to the edge, as long as enough “stars” are in sight of the tracking camera.

Whereas other systems are often restricted in their tracking volume, StarTracker works in studios between 9 to 60 ft in height.

Post-Production

While the StarTracker enables on-set visualization in real-time, as well as scene blocking in virtual worlds, it will also provide timecode synchronization and an FBX export.

This captured data allows you to efficiently drop the recorded data and footage into post-production software.

Who Are We?

Cobalt combines state-of-the-art stages and savvy production solutions – a true all-in-one answer. Decades of firsthand experience showed us the value of a fully equipped, turnkey production campus, so we created Cobalt to encompass our values of hospitality, superior support, innovative technology and unprecedented accessibility.

Cobalt was the first to offer Virtual Production to the East Coast film community in 2015. We are woman owned and led.

Take advantage of our amazing inventory of production tools and elevate your image for your next project with us!

Want to learn about Virtual Production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.

Need Production solutions and support?

Cobalt Produces Multiple Episodes for Global Brand Using Virtual Production: A Case Study

Cobalt Produces Multiple Episodes for Global Brand Using Virtual Production: A Case Study

We recently wrapped an incredible project for an international brand (you’ve definitely heard of them), and would love to take a minute to talk about it. Of course, we understand how secrets work, so we’re taking a ride on the vague train! Not to worry, we’ll cautiously break it down for you as we’re highly aware of what can and cannot be shared 😉

That said, we think it’s important to discuss the process and how we created two white-label episodes in record time… for a fraction of the budget.

In turn, our production client was able to impress their global client. Meaning, everyone benefited from our Virtual Production methodology.

Let’s take a minute to look at the challenges presented at the top, the solution we developed, and the key takeaways at the end.

Project Overview

In this recent case, an enterprise business approached us needing two episodes for in-house training that they produce several times a year. These episodes play on their in-house channel for their branded network. They are shown to over 100,000 employees worldwide, and are used to leverage critical security protocols (among other things).

Each program highlights a form of data security and best practices. It typically involves some type of hacker, doing something, that eventually compromises different types of data. Basically, the hacker is after your data, so what are you going to do to combat it?

In this project, Kara & Alex took the reins, co-directing and producing both episodes. This was only after they thoroughly listened to the key problems, discussed challenges, and brainstormed the best solution. And all of this because? Cobalt Stages is a production company first—that just so happens to offer amazing turnkey soundstages.

Initial Challenges

So, what were the main problems this client faced?

The main issues were timing and budget. In the past, these episodes were shot on location, mostly within the United States. More than 30 programs had already been produced, but the episodic lacked global context and relevance that reflected the brand’s expansion.

Thus, the client wanted to shoot in four global cities (capturing the nuances, their tones and textures without the prohibitive cost of international globetrotting). They also considered subtitles and dubbing for universal appeal. The client expressed that they understood the reach, but they really needed to hit one out of the park, and they were hoping we were just the team to make it happen.

This truly was the greatest challenge:

- What is the smartest production modality for the best production value?

- How can an international shoot be accomplished with limited funds?

- How can we depict a myriad of global cities without stepping foot outside of the US?

We rolled up our sleeves, sly smiles painted on our faces. We had JUST the solution!

Working Solution

In order to offer our client a high production value, with infinitely lower costs, we suggested the use of Virtual Production. This gave them the ability to appear as if they were shooting in several different cities and scenes, all without leaving the Woodstock soundstage.

Planning and Storyboard

We needed to recreate several scenes, both interior and exterior, with extras and dialogue. The first scene was a clean and organized control room monitored at the company’s HQ. It had to contain lots of screens, monitors, and details. The other scene was a grungy and dark hacker’s lair, that required a lot of texture.

Methodology and Technology

After careful planning, we were able to do a 4K live composite using our Virtual Mo-Sys technology. We created CG environments, coupled with small, practical sets, which gave actors the ability to relate to and touch the equipment. This enabled us to output live, 4K resolution composites of the CG environment paired with performance live-action.

In both scenes, we had video screens composited all over the place. This enabled us to recreate rich depth, like moving cars in the background of the hacker’s lair or extras walking in Chicago’s Millennium Park, their images reflecting perfectly off the famous Bean.

Virtual Production also gave us the power to change the time of day or even the season, with the simple click of a button. How’s that for saving time and money?

Crews and Resources

Cobalt prioritizes production, and we collaborate with a wide range of networks to get the job done. In this case, we used a mix of local and city crews to save money and facilitate the entire workflow.

We possess a huge roster of local talent, so if you’re coming from out of town, that’s one less thing to worry about. We also offer an array of opportunities in case you want to bring your own people (deep discounts for food and lodging, anyone?).

Key Takeaway

At the end of the day, the project was a huge success. The client came out and shot two ambitious episodes that took them around the world in just three days!

Even better, they were able to impress their own client. They demonstrated that the same level of quality, production value, and depth from past award-winning episodes, could be recreated at a percentage of the price.

How much would it have cost to ship this crew across the world for several different shoots, over weeks of time? What would it cost to build each set and hire local talent in four different locations?

The answer is simple. Virtual Production is leading the forefront of AI-enhanced production. It’s a technology that can save a global brand thousands of dollars, hundreds of hours, and priceless business relationships.

Ready to slash your budget and save time on your next production? We’re ready to brainstorm.

Want to learn about Virtual Production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.