What is the New York State Film Tax Credit Program?

Did you know filming in New York has incredible tax benefits? The Governor’s Office of Motion Picture & Television Development (MPTV) offers film, television, and commercial production and post-production tax credits for qualified expenditures in New York State.

This $700 million film incentive program is one of the best in the nation!

However, WHERE you film in the state can mean the difference between saving 25% or 45% in film tax credits. For a larger production, this could be huge.

Ulster County-based production and post-production efforts benefit from the highest level of NY film tax credits available in NYS and the country, at large.

Here we take a quick look at the New York State Film Tax Credit Program, including the type of credits available, eligibility, and the latest changes in regulation.

The Purpose Behind the Program

The initial purpose behind the New York State Film Tax Credit Program is that it was designed to increase the film production and post-production industry presence and overall positive impact on the state’s economy.

What does it do?

The Film Tax Credit Program provides incentives to qualified production companies that produce:

-

Feature films

-

Television series

-

Relocated television series

-

Television pilots

-

Television movies

-

and/or incur post-production costs associated with the original creation of these film productions.

The Film Tax Credit Program is divided into two distinct programs:

Program #1: The Film Production Credit

Program #2: The Post-Production Credit

The first program is outlined in detail below, and you’ll find the post-production program on the next blog.

Why New York State?

New York State has a dynamic and diverse film and television production presence, worldwide, boasting a strong infrastructure and robust economy. It’s one of the top states with film credits and offers some of the highest percentages for film tax relief.

Upstate New York

Upstate New York really has it all. It offers unique features and services to accommodate any number of film projects, including varied terrain, period and futuristic settings, urban and small-town backgrounds, local crew and warehouses, plenty of office space, and a local government that supports and encourages filming.

And if you can’t find your typical location, Upstate New York houses the new Cobalt Stages facility just outside the historic town of Woodstock. Cobalt Woodstock has brought its EFX and Virtual Production to the already vibrant Hudson Valley Film scene.

Upstate New York boasts four distinct seasons, allowing you to capture the changing beauty of nature throughout the year. Additionally, New York tax credits can significantly reduce production costs and make your project more economically viable.

The welcoming and supportive local communities further contribute to the practical advantages of choosing Upstate New York as your filming location and production hub. The region not only offers a visually compelling setting, but practical incentives help to level up your production.

Amount of Credit Available

Program credits of $700 million per year are allocated and used to encourage companies to film projects in New York, and create and maintain film industry jobs.

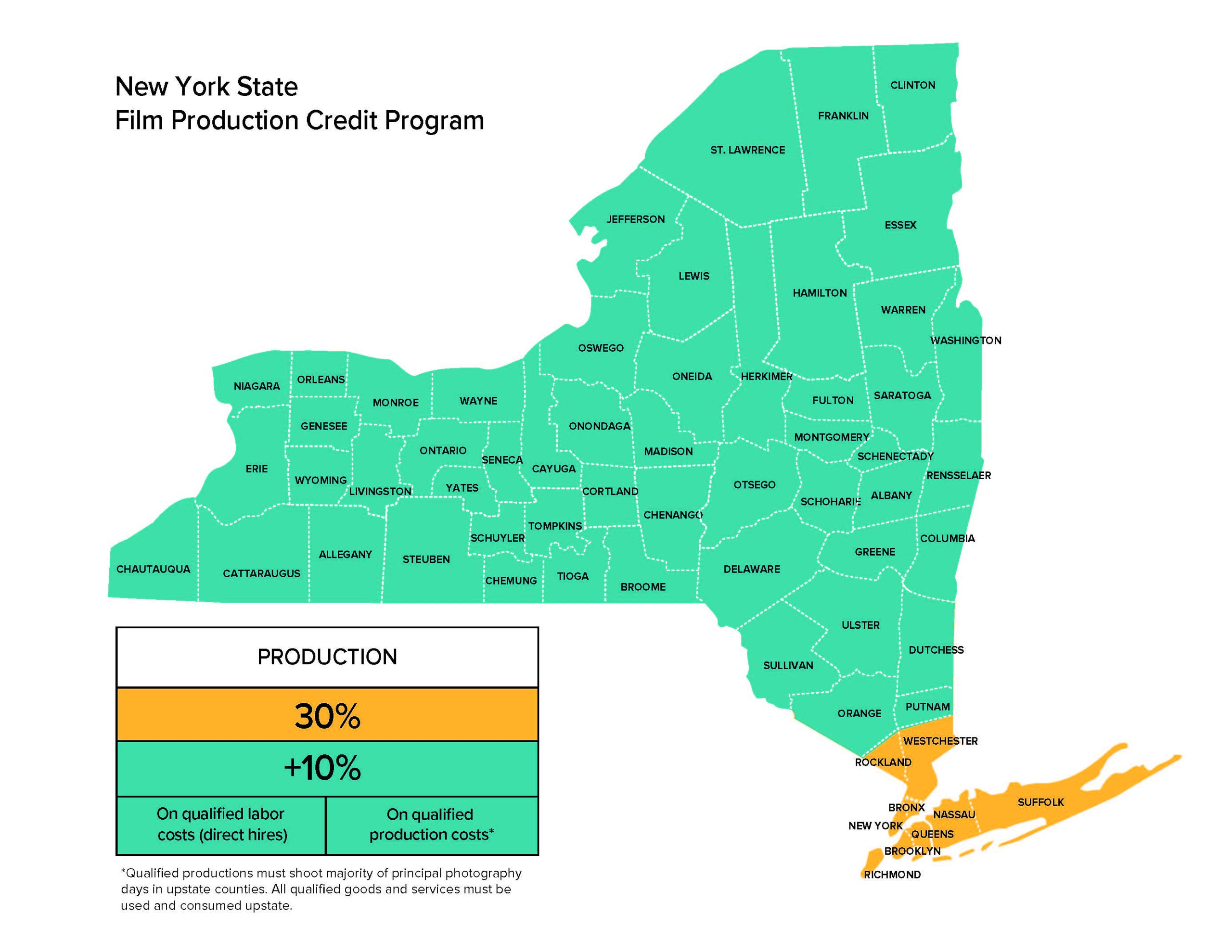

Film Production Credit applicants are eligible to receive a fully refundable, baseline credit of 30% of qualified production costs incurred in New York State (NYS). You are eligible to receive an extra 10% off for production in Upstate NY. Then, Upstate even offers an extra extra 5% on post. This all relates to outside the Metropolitan Commuter Transportation District (MCTD).

This brings the entire possible New York state tax credit to a total of 40% savings for production and 45% for post-production in Upstate territories.

Please note, that there are no per-project caps for credits, and there is a rollover in the annual $700 million allocation going forward until 2034.

Eligible Counties for an Additional Credit

In addition to the 30% NYS film tax credit, from 2015-2034, any production with a budget over $500,000 can receive an additional 10% credit on qualified labor expenses incurred in the following counties:

Albany, Allegany, Broome, Cattaraugus, Cayuga, Chautauqua, Chemung, Chenango, Clinton, Columbia, Cortland, Delaware, Dutchess, Erie, Essex, Franklin, Fulton, Genesee, Greene, Hamilton, Herkimer, Jefferson, Lewis, Livingston, Madison, Monroe, Montgomery, Niagara, Oneida, Onondaga, Ontario, Orange, Orleans, Oswego, Otsego, Putnam, Rensselaer, Saratoga, Schenectady, Schoharie, Schuyler, Seneca, St. Lawrence, Steuben, Sullivan, Tioga, Tompkins, Ulster, Warren, Washington, Wayne, Wyoming, or Yates.

Click here for specific tax credits for Ulster County.

Eligibility Criteria

The Film Tax Credit Program is limited to film production companies producing feature films, television series, relocated television series, television pilots, and television movies. Television series and relocated television series must submit separate applications for each complete season to be eligible for New York tax credits.

The production credit is available for companies that film a substantial portion of their project in NYS.

Eligibility requirements vary based on the type of company and the budget.

- Level 2: If the film has a production budget over $15 million and/or is being produced by a publicly traded entity; at least 10% of the total principal photography shooting days must be at a qualified production facility (QPF) in NYS on a set built expressly for the production. This can also include virtual production.

- Level 1: Productions with budgets of $15 million or less produced by companies that are independently owned must shoot at least one full day of principal photography at a QPF on a set built expressly for the production.

For the purposes of this program, a full day means a minimum of eight hours from the first unit crew call to wrap.

Principal photography is defined by criteria including, but not limited to, the presence of first unit crew, director, and principal performers, and the recording of scenes in which lines of dialogue are spoken.

Re-shoot days with actors, directors, and crew are considered principal photography. Second-unit shoots and pickup shots without director and actor(s) are not considered principal photography.

Excluded Categories

Documentaries, news or current affairs programs, interview or talk shows, variety talk, variety sketch and variety entertainment shows, instructional videos, sports shows or events, daytime soap operas, reality programs, commercials, and music videos.

Latest Changes to the Tax Credit Program

Some of the latest changes to the tax program (as of 2023) that you may need to be aware of include:

- The base tax credit rate has increased to 30%.

- Effective April 1, 2023, those applicants with a tax credit allocation year of 2024 and thereafter may file a return for the first taxable year in the allocation year cited on the New York tax credit certificate.

- Annual allocation has increased to $700 million, of which $45 million is allocated to the Post Production Tax Credit Program. Allocation for the program continues through 2034.

- These Above-The-Line (ATL) salaries are qualified for the tax credit:

• Director

• Writers

• Actors

• Composers

• 2 Producers (one EP responsible for overall creative management, and one LP responsible for overall production management). - ATL salaries identified are subject to a $500,000 cap per individual and limited to 40% of all other qualified production costs.

- A Relocating Talk/Variety series must be in production outside NYS for two years only (reduced from 5 years).

- Relocating Television series (narrative dramatic or comedy series) must have been in production outside NYS for a minimum of six episodes with a per-episode budget of $1 million minimum.

- For network/cable, the length requirement is at least 30 minutes with commercials; for streaming media, the length must be at least 75 minutes for the total number of episodes in the season.

- Production costs of up to $6 million for relocation (excluding salaries) are eligible for the NY film tax credit for the first season in NYS.

- Effective January 1, 2023, applicants to the NY State Film Production tax credit program are required to file a diversity plan outlining specific goals and strategies for hiring a diverse workforce.

Ready to Apply?

Application Process

Applicants complete and submit the Project Summary Form online.

All other documents that comprise a complete application are submitted through the secure file transfer system. It is highly recommended that applications be submitted at least 10 business days prior to the start of principal photography.

When submitting an application for Film Production Credit, all materials must be submitted in order for the application to be deemed complete.

- Online Application Form<

- Chart of Application Materials for the Film Tax Credit<

- Application Instructions<

- Program Guidelines

For the Film Production Credit, applications must be submitted prior to the start of principal and ongoing photography.

Summing it Up

Filming your movie in Upstate New York comes with the added benefit of the state’s robust film production tax credit program. New York offers filmmakers a competitive incentive package, which includes:

- A 30% tax credit on qualified production expenditures

- An additional 10% credit for qualified productions in certain upstate counties

- A 45% credit for post-production work

These film production tax credits can significantly alleviate production costs, making Upstate New York an economically attractive

choice for filmmakers.

New York’s commitment to supporting the film industry extends beyond financial incentives fostering a thriving creative community that

offers valuable resources for filmmakers.

Choosing Woodstock as your prime location not only provides a visually captivating backdrop, but presents a strategic financial advantage

that ensures a compelling and cost-effective production experience.

Ready to get started?

Let’s talk

Come visit Cobalt Woodstock.

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.