New York State Film Tax Credit Program (Post-Production)

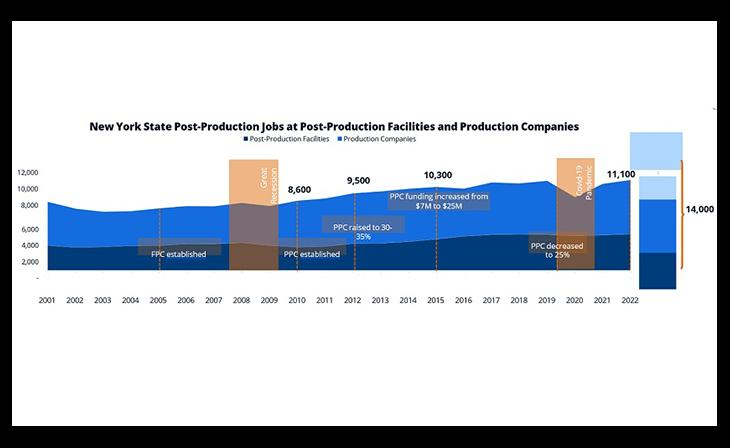

The New York State Film Tax Credit program and Post-Production program offers the entertainment industry one of the country’s most stable, strategic, and successful tax credits. Of the $700 million available in the program, $45 million every year has been allotted to expenses for post-production costs.

The Film Tax Credit program is divided into two distinct programs:

- the Film Production Credit

- the Post-Production Credit

While the production credit is available for businesses that film a substantial portion of their project in New York State, the post-production credit is available even if the majority of the project was filmed outside of the state.

Creators are also encouraged to apply if they were ineligible for the production tax credit program. This happens when the production company contracts their post-production work to NYS post-production companies.

Here we take a quick look at the New York Post-Production Film Tax Credit program including a brief overview, eligibility, and how to apply.

Objective and Overview

The main goal of the Post-Production Tax Credit program is to strengthen the post-production industry in New York State, and boost the positive impact it has on the economy.

Who Can Apply?

The Film Tax Credit program provides incentives to qualified production companies that produce:

- Feature films

- Television series

- Relocated television series

- Television pilots

- Television movies

- and/or incur post-production costs associated with the original creation of these film productions

Program Highlights

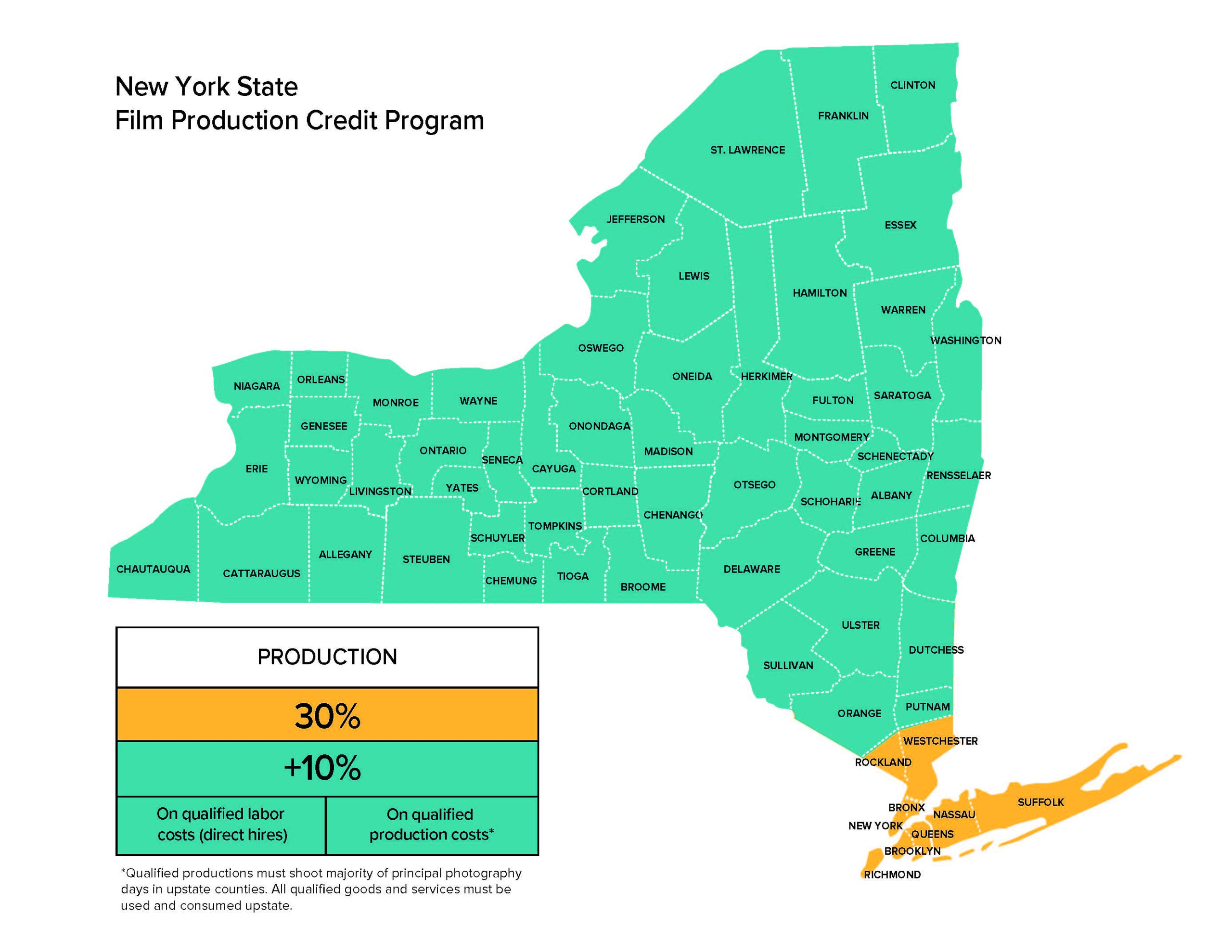

To encourage companies to develop their film projects in New York and to help create and maintain jobs, productions that comply with program requirements may be eligible for:

- A fully refundable tax credit of 30% of qualified post-production expenses. This Post-Production tax credit program is funded at $45 million a year through 2034.

- An additional 5% credit is available with the Post-Production program for costs incurred in Upstate NY, outside the Metropolitan Commuter Transportation District (MCTD).

- Projects with budgets over $500,000 can receive an additional 10% credit on qualified labor expenses incurred in the following counties:

Albany, Allegany, Broome, Cattaraugus, Cayuga, Chautauqua, Chemung, Chenango, Clinton, Columbia, Cortland, Delaware, Dutchess, Erie, Essex, Franklin, Fulton, Genesee, Greene, Hamilton, Herkimer, Jefferson, Lewis, Livingston, Madison, Monroe, Montgomery, Niagara, Oneida, Onondaga, Ontario, Orange, Orleans, Oswego, Otsego, Putnam, Rensselaer, Saratoga, Schenectady, Schoharie, Schuyler, Seneca, St. Lawrence, Steuben, Sullivan, Tioga, Tompkins, Ulster, Warren, Washington, Wayne, Wyoming, or Yates.

Click here for specific tax credits for Ulster County.

Eligibility

rat, helvetica, arial, sans-serif;”> New York Post-Production program is limited to the post-production of feature films, television series, relocated television series, television pilots, and films for television.

The post-production credit is available when the project was filmed predominantly outside of New York State, and the film production company contracts their post-production work to companies in NYS specializing in post-production work.

Post-Production Credit

Post-production costs (associated with the production of original content for a qualified film) incurred at a qualified post-production facility in New York State are eligible.

What is a qualified post-production facility?

A qualified post-production facility is any company located in NYS and engaged in providing post-production services to film and television.

A film production company can qualify for the post-production credit if it meets either one or both of the following thresholds:

#1) Visual Effects and Animation

The qualified VFX/Animation costs incurred at a qualified post-production facility in NYS must EITHER meet or exceed:

– 20% of the total VFX/Animation costs paid;

– OR incurred for VFX/Animation for the qualified film at any post-production facility anywhere;

– OR $3 million Post-Production.

The qualified post-production costs incurred at qualified facilities in NYS (excluding cost for VFX/Animation) must meet or exceed 75% of the total qualified post-production costs paid or incurred in the post-production of the film at any post-production facilities.

#2) Fully Animated Production/Post-Production

A company engaged in the production of a fully animated film is eligible for the Post-Production Credit if the qualified production and post-production costs meet the VFX/Animation threshold of 20%; expenses in the Producer, Director, and Deliverable Elements categories are also qualified if they meet the Post-Production 75% threshold.

Ready to Apply?

Application Process

Applicants complete and submit the Project Summary Form online.

All other documents that comprise a complete application are submitted through the secure file transfer system. It is highly recommended that applications be submitted at least 10 business days prior to the start of principal photography.

When submitting an application for the Post-Production Credit, all materials must be submitted in order for the application to be considered complete.

- Online Application Form

- Chart of Application Materials for the Film Tax Credit

- Application Instructions

- Program Guidelines

Post-Production Credit

Complete initial and final application forms are either online or downloadable.

The Post-Production Credit application must be filed prior to incurring any qualified costs in New York State. Thus, it is recommended (but not required) that the initial application be submitted prior to the start of principal photography on the qualified film (or tv pilot/series).

Upon completion of post-production, a final application must be submitted with actual project information. When the final application is deemed complete, the program Office will notify an applicant that the application is ready for audit.

After the audit, a Certificate of Tax Credit may be issued and sent to the applicant listed in the final application.

- Post-Production – Initial Application Template Book – The Post-Production Credit Initial Application Template file contains the following templates for submission via the online application:

- Budget Cost Qualifier (Live Action and Animation)

- Schedule of Qualified Expenditures (Live Action and Animation)

- Project Summary – Post-Production Credit – Final Application (Online Application Form)

- Post-Production – Final Application Template Book – The Post-Production Credit Final Application Template file contains the following templates for submission via the online application:

- Budget Cost Qualifier Summary Page (Live Action and Animation)

- Budget Cost Qualifier Detail Page (Live Action and Animation)

- Schedule of Qualified Expenditures (Live Action and Animation)

- Employment Report

- Retained Assets Report

- Related Party Transaction Report

CONTACT INFORMATION

For more details or if you have specific questions, please contact the Film Tax Credit program at (212) 803-2328 or via email at filmcredits@esd.ny.gov.

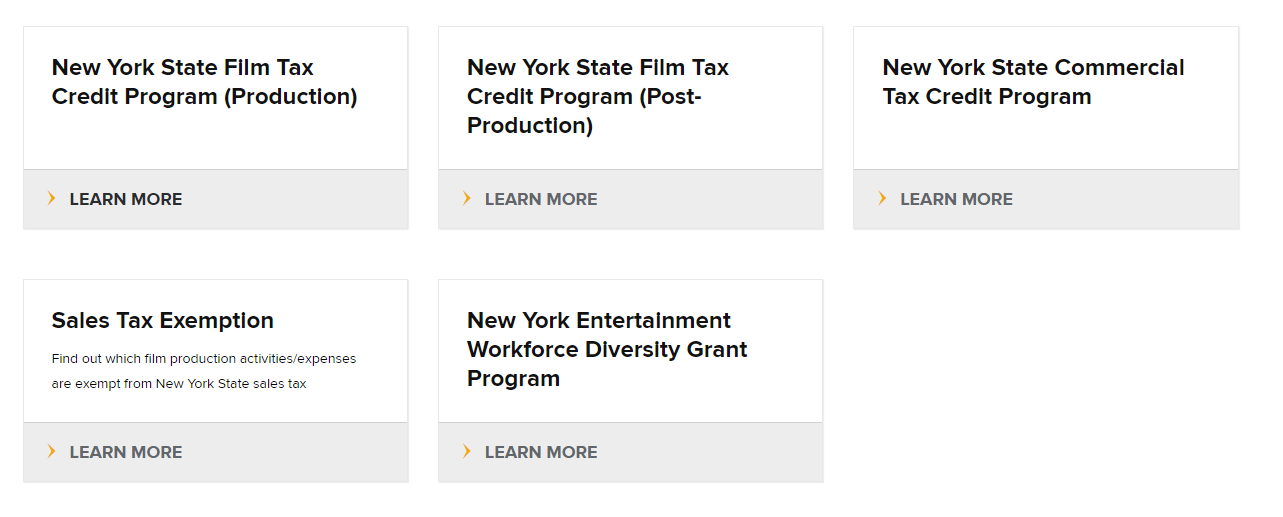

All New York State Tax Incentives

New York State has a variety of film tax programs to incentivize the film and television industry in the form of tax credits, sales tax exemptions and grants to support workforce diversity, training and job creation.

Summing it Up

Filming your movie in Upstate New York comes with the added benefit of the state’s robust film production tax credit program. New York offers filmmakers a competitive incentive package for post-production credits which include:

- A fully refundable tax credit of 30% of qualified post-production expenses.

- An additional 5% credit may be available in the Post-Production program for costs incurred in Upstate NY.

- An additional 10% credit on qualified labor expenses.

These post-production tax credits will significantly alleviate production costs making Upstate New York an economically attractive choice for filmmakers.

New York’s commitment to supporting the film industry extends far beyond financial incentives helping to foster a thriving, creative community that offers valuable resources for filmmakers.

Choosing Woodstock as your prime location not only provides a visually captivating backdrop, but presents a strategic financial advantage that ensures a compelling and cost-effective production experience.

Ready to get started?

Come visit Cobalt Woodstock.

Want to learn about virtual production and how to use it?

Cobalt’s got you covered. As the first company to offer Virtual Sets on the East Coast, we have the experience to guide you. Let’s have some fun.